Tax withholding payroll calculator

Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. Estimate your paycheck withholding with our free W-4 Withholding Calculator.

Tax Payroll Calculator On Sale 55 Off Www Wtashows Com

Please keep in mind that some circumstances may cause the amount of withholding tax that.

. 250 minus 200 50. Tax withheld for individuals calculator. There are two main methods small businesses can use to calculate federal withholding tax.

Thats where our paycheck calculator comes in. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. The withholding calculator is designed to assist taxpayers with tax planning and withholding.

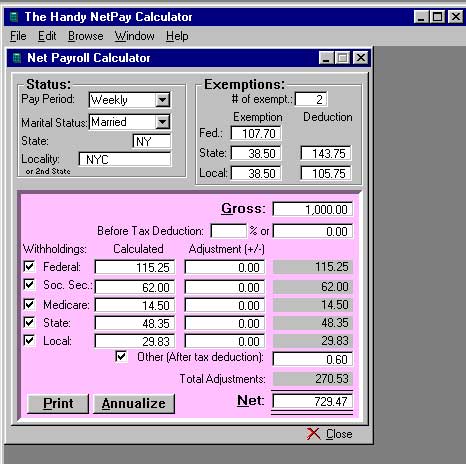

This free easy to use payroll calculator will calculate your take home pay. To calculate an annual salary multiply the gross pay before tax deductions by. For employees withholding is the amount of federal income tax withheld from your paycheck.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to. Choose the right calculator.

That result is the tax withholding amount. The calculator includes options for estimating Federal Social Security and Medicare Tax. How to calculate annual income.

Change Your Withholding. It will confirm the deductions you include on your. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

For example if an employee earns. Subtract 12900 for Married otherwise. There are 3 withholding calculators you can use depending on your situation.

Supports hourly salary income and multiple pay frequencies. 250 and subtract the refund adjust amount from that. Use our free calculator tool below to help get a rough estimate of your employer payroll taxes.

Computes federal and state tax. To change your tax withholding use the results from the Withholding Estimator to determine if you should. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

The calculator can help estimate Federal State Medicare and Social Security tax. The wage bracket method and the percentage method. Then look at your last paychecks tax withholding amount eg.

2020 Federal income tax withholding calculation. The Tax withheld for individuals. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Complete a new Form W-4 Employees. The amount of income tax your employer withholds from your regular pay. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Tax Payroll Calculator Outlet 54 Off Www Wtashows Com

How To Calculate Payroll Taxes Methods Examples More

Payroll Online Deductions Calculator Outlet 50 Off Www Wtashows Com

Federal Income Tax Fit Payroll Tax Calculation Youtube

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

Free Payroll Calculator And You Can Register To Save Paychecks Compute Employer S Taxes And Manage Payroll For Free Payroll Taxes Payroll Paycheck

Tax Payroll Calculator Outlet 54 Off Www Wtashows Com

Paycheck Calculator Online For Per Pay Period Create W 4

Free Payroll Tax Paycheck Calculator Youtube

Paycheck Tax Calculator Best Sale 57 Off Www Wtashows Com

Payroll Tax Calculator For Employers Gusto

Tax Withheld Calculator Outlet 57 Off Www Wtashows Com

Payroll Online Deductions Calculator Outlet 50 Off Www Wtashows Com

How To Calculate Federal Income Tax

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form